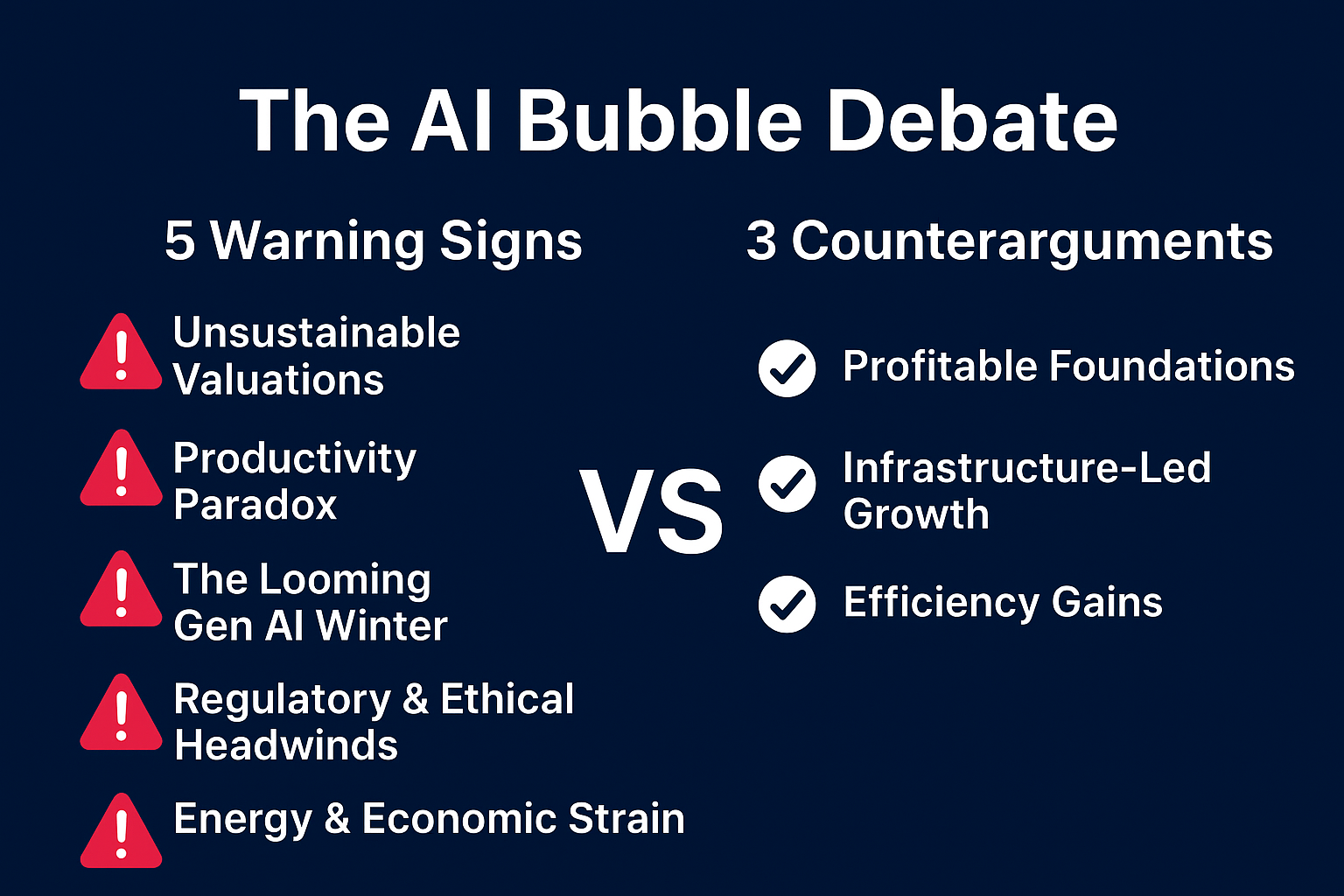

Why This Feels Like a Bubble:

1. Unsustainable Valuations

— Nvidia’s market cap surged to $4.4 trillion (surpassing Microsoft) despite 96% of revenue tied to chips, not AI applications .

— Startups like “Thinking Machines” secured $2B funding at $12B valuations with no revenue.

2. Productivity Paradox

— Despite $100B+ annual AI investment, U.S. labor productivity grew just 1% yearly since 2022 .

— OpenAI’s ChatGPT has 1.5B monthly users but only 15.5M paying subscribers (0.96% conversion), raising monetization doubts.

3. The Looming Gen AI Winter

— Recession Risks: If budgets tighten & ROI fails to materialize (e.g., 67% of enterprises report stalled AI pilots), funding could collapse — mirroring the 1980s AI winter .

— Hallucination Costs: IBM estimates AI errors drain $40B annually from businesses, eroding trust .

4. Regulatory & Ethical Headwinds

— Copyright lawsuits threaten $16B/year in liabilities, while AI incidents rose 300%+ since 2023 .

— Google removed its “no AI weapons” pledge in 2025, signaling ethical trade-offs .

5. Energy & Economic Strain

— AI data centers consume 10x more power than traditional servers, driving U.S. electricity prices up 6.5% in 2025 .

— Goldman Sachs warns AI must solve a $1T problem to justify investments — a target even optimists call “aspirational” .

Why It Might Not Be a Bubble

1. Profitable Foundations

— Microsoft & Nvidia generated $28B and $12B net income in 2025, unlike profitless dot-coms .

— 78% of enterprises now use AI, with 71% adopting generative AI — signaling real adoption .

2. Infrastructure-Led Growth

— AI’s “picks and shovels” phase (chips, cloud) mirrors railroads — a necessary precursor to applications .

— Governments pledged $150B+ in AI investments (e.g., China’s $47.5B semiconductor fund) .

3. Efficiency Gains

— AI inference costs dropped 280-fold since 2022, while energy efficiency improved 40% annually .

— Open-source models like DeepSeek narrowed performance gaps with closed models from 8% to 1.7% in a year .

AI’s Make-or-Break Moment

Three challenges will determine AI’s future:

1. ROI Reality Check

— Most AI projects cost more than they earn. Without tangible returns, a “Gen AI winter” looms.

2. Beyond Brilliant Idiots

— Current AI aces tests but fails unpredictably in practice. Real-world reliability is non-negotiable.

3. Funding Countdown

— With $100B+ invested annually, AI must deliver profits before capital retreats.

The Verdict:

AI is not doomed — but it’s not invincible either. The next 6–9 months will separate the winners (those delivering scalable, reliable value) from the losers (those stuck in *hype-driven POCs).

The question isn’t *if* AI will transform industries — it’s which companies will still be standing when the dust settles.